ARTICLES: Gemstones as an Alternative Investment

Gemstones as an Alternative Investment

Gemstone investing is one of the riskiest kinds of investments and there are many ways to lose invested capital including fraud, political risk, subjective valuations and low liquidity, but there are opportunities for savvy and knowledgeable gemstone collectors to not only enjoy, hold and admire their purchases, but to realize exceptional returns in a flat stock market.

Gemstones have been traded and admired for the last 6000 years, so there is little doubt that their popularity and desirability will continue. Like every other precious commodity, gemstone prices are always a function of supply and demand, but unlike gold, gemstones are not created equal and politics, war, science and fashion are big factors in the world of investing in precious stones.

And wherever there is high value, there is opportunity for fraud or misrepresentation and in this regard, gemstones are not different from other investments.

Diamonds may not be an investor's best friend

Diamonds have been heavily promoted for the last 100 years and large quantities of stones already exist in public hands. In fact, "A Diamond is Forever" is recognized as the most effective advertising slogan of the twentieth century. This huge public diamond stock is offset in part by the actions of a few large cartels that try to effectively control the output and offering of new material. Since diamonds are found in ancient volcanic diamond pipes, the deposits are more concentrated and the valuations are high enough to enable large scale mining and production at a few specific locations. Production is usually plentiful enough to keep the market supplied and prevent shortages so diamond prices generally remain stable.

Diamonds are the ideal product – tough, durable, beautiful and neutrally colored to match any other gemstone and any color of clothing. However, because diamond production and output is at least partially controlled, diamond prices have not increased significantly over the last 30 years. It is in the interest of the large diamond traders and mining companies to keep prices stable and they have been quite successful in that regard. There have been price spikes, but in general, diamond prices have kept pace with inflation and stock markets and they have not shown exceptional returns for passive investors.

On the other hand, diamonds are much more liquid than colored stones and it’s never too hard to find a buyer for a diamond. Although the offers may not be great, a market for secondary diamonds is always available and nice diamonds are not hard to resell. For dealers, jewelers, and careful investors, diamonds can offer a hedge against inflation, but the upside potential for novice investors is not high.

Are colored stones a good investment?

Investing in colored stones requires expertise, more knowledge and research, but the potential for profitability is higher. While rubies, sapphires and emeralds may offer excellent investment opportunities, more obscure gemstones may offer even better returns. Unlike diamonds, colored gemstones are most typically found in alluvial deposits where ancient rivers deposited the gems millions of years ago. As a result they are buried in small very difficult to find pockets. If a discovery of valuable material occurs, it is rarely kept secret and the location will usually be descended upon by thousands of miners or diggers within days or weeks. Within a short period, most of the material is gone and there’s no way to get more until the next discovery. Although there are exceptions like when the source of the material is found, as in the case of tanzanite, most gemstone deposits are discovered and mined out within months or days and rarely yield anything after a year or two.

Ideally, investment color stones should weigh over 2.00 cts and color, cut, clarity, durability, origin and rarity are all important factors that need to be considered. For the more well known gemstone groups like rubies, sapphires, emeralds , alexandrite, investment stones should generally cost more than $3000 simply because less expensive gemstones will be too common and an investment stone needs to be both rare and valuable. There is no limit on the higher end, but there will always be less potential buyers for the most expensive high-end stones.

The best investment stones are those that are beautiful and very hard to find. While stones like amethyst, citrine, or almandite, are nice for jewelry, they would not be considered to be investments because they are too common. Stones like red spinels, rubies, sapphires, emeralds, blue tourmalines, tsavorites , demantoids and alexandrites can be considered for investment and have in some cases have shown marked appreciations over the last 30 years. More specifically, some spinel, demantoid, tsavorite, alexandrite, and Paraiba tourmaline prices have increased by more than 20 times over the last 30 years.

One way to find value is to look at stones similar in color and appearance and then compare beauty, durability and rarity. The following example compares 4 blue stones: sapphire , tanzanite , spinel and hauyn.

Sapphires have the highest historical value. They are tough and durable and should be highly valued if they are beautiful and large enough to be considered rare. For first-time investors, blue sapphire is probably the safest, but the most expensive bet.

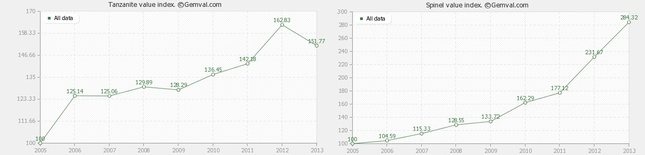

(Historical average values for Tanzanite and Spinel by GemVal)

Tanzanite’s has been mined in serious quantities over the last 30 years and large sizes are available. But given the significant differences in availability and hardness, blue spinel would clearly be the better choice for the knowledgeable investor in a similar color, price and size range.

Hauyn is a brightly colored collector favorite occurring only in Germany. Hauyn is extremely rare and even stones weighing over .10cts. are uncommon. A high quality Hauyn provides interesting opportunities for investors, and there are always collectors looking for those.

For the less common gemstones and rare mineral specimens, there are also options in lower price ranges and this where some of the best opportunities may lie.

Buying at the source requires the most expertise and this is where many buyers are fooled by tricksters or coerced into make poor choices. Buying online, gem shows, or from privates can be a good alternative, but sellers should offer independent gem lab certification, so the risks of misinformation can be greatly reduced. Ultimately, the best protection is knowledge, independent lab certification, and buying from a reputable source.

Co-founder and partner at Multicolour Gems, David Weinberg is an American gemologist and gemstone connoisseur with over 30 years experience of mining, buying, faceting, selling and studying color gemstones.